The Anatomy of a Credit Score: Understanding How It's Calculated

A credit score is a numerical representation of an individual's creditworthiness. It is a measure of how likely a person is to repay their debts based on their credit history. Credit scores are used by lenders, landlords, and insurance companies to assess the risk of lending money or extending credit to an individual.

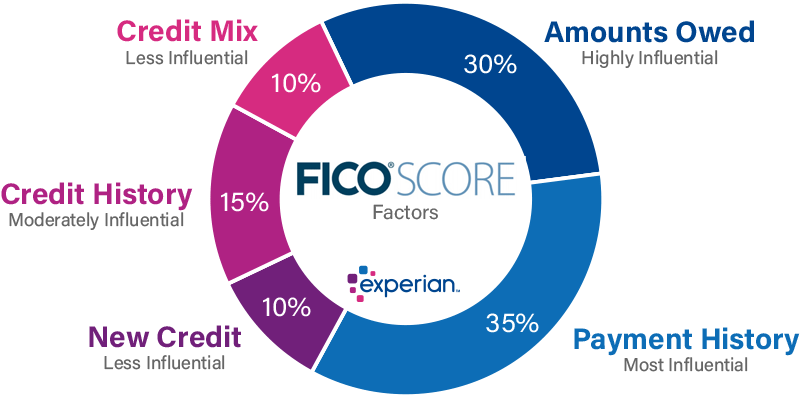

There are several factors that go into calculating a credit score. Here are the most important ones:

Payment history: This is the most critical factor in determining your credit score. It shows whether you have paid your bills on time, how frequently you have missed payments, and how long you have gone without making a payment. Late payments, defaults, and collections negatively impact your credit score.

Credit utilization: This is the percentage of your available credit that you are using. High credit utilization indicates that you are relying heavily on credit and may be a risky borrower. Keeping your credit utilization below 30% is considered good for your credit score.

Length of credit history: The length of your credit history is the amount of time you have had credit accounts open. A longer credit history shows that you have a track record of using credit responsibly, which can positively impact your credit score.

Credit mix: Your credit mix refers to the different types of credit accounts you have, such as credit cards, car loans, and mortgages. Having a variety of credit types can show that you are responsible with different types of credit, which can positively impact your credit score.

New credit: Every time you apply for credit, it creates a hard inquiry on your credit report. Having too many hard inquiries in a short period can negatively impact your credit score. It is best to limit your applications for credit to when you really need it.

Once these factors are considered, credit bureaus like Equifax, Experian, and TransUnion assign a credit score to an individual. The most commonly used credit score model is the FICO score, which ranges from 300 to 850. A higher score indicates a better credit history and a lower risk to lenders.

It's important to note that different lenders may use different scoring models or have different criteria for evaluating creditworthiness. As such, your credit score may vary depending on who is looking at it. Nonetheless, understanding the factors that go into calculating your credit score can help you make better decisions about your credit usage and maintain a good credit history.